Trade Docs

Transform your trade operations with legally-binding digital documents that revolutionize global commerce

- Legal Validity

- Global Standards

Global Trade Still Runs on Paper & PDFs

Billions of trade documents are still processed manually, creating massive inefficiencies and risks across the global supply chain.

Document Fraud & Loss

Paper documents worth $50B+ lost annually to fraud, forgery, and physical damage

Processing Delays

Manual verification takes 7-14 days, delaying shipments and increasing costs

Supply Chain Opacity

Zero visibility into document status across multi-tier supply chains

Compliance Gaps

Inconsistent audit trails create regulatory and financial risks

Digital Transformation

Trade Docs eliminates these pain points with legally-binding digital documents, instant verification, and complete supply chain transparency.

99.9%

Fraud Reduction

80%

Faster Processing

What is MLETR?

The Model Law on Electronic Transferable Records (MLETR) is a groundbreaking legal framework that enables the creation and use of electronic transferable records with the same legal status as their paper equivalents.

Legal Framework

UNCITRAL Model Law providing legal foundation for electronic transferable records

Functional Equivalence

Digital documents have the same legal effect as their paper counterparts

Control Standards

Establishes criteria for possession and control of electronic records

International Recognition

Growing adoption by countries worldwide for cross-border trade

Trade Docs is fully MLETR compliant

Our platform ensures that all digital documents created meet MLETR standards, providing legal certainty and global

interoperability for your trade operations.

MLETR Adoption

Countries worldwide are adopting MLETR to modernize their trade laws and enable digital transformation of trade finance.

Built on Global Standards

Full legal validity and worldwide interoperability through MLETR compliance and TradeTrust verification

MLETR Compliant

Electronic documents with the same legal validity as paper originals

TradeTrust Verified

Third-party verification ensuring global interoperability

Blockchain Anchored

Immutable audit trails with complete document integrity

Digitize Every Document That Moves Trade

From Bills of Lading to Certificates of Origin – complete support for all critical trade documentation

Bill of Exchange

Digital bill of exchange with legal vaidity

Promissory Notes

Electronic promissory notes with transfer capability

Bill of Lading

Digital B/L with transfer of control

Certificate of Origin

Origin verification documents

Enterprise-Ready Features

Comprehensive capabilities designed for modern trade operations and complex enterprise workflows

Universal Document Digitization

Enable creation of Digital Originals for any Trade or B2B Credit document - including both Transferable (title-based) and Verifiable formats.

Custom Workflow Configuration

Design flexible document workflows with user-defined roles (e.g., Maker-Checker), multi-party collaboration, automated notifications, and lifecycle triggers.

Cross-Platform Document Transfers

Seamlessly transfer documents to blockchain wallet addresses, even if recipients are not onboarded to the platform.

AI-Powered Paper Digitization

Leverage AI to extract data from scanned or paper documents and generate compliant Digital Originals within the platform. Custody solutions for original paper documents are under active evaluation.

Whitelabel and Enterprise Customization

Offer a fully brandable solution tailored to client-specific requirements, whether as a SaaS or enterprise deployment.

One Platform, Every Stakeholder

Empowering every participant in the global trade ecosystem with seamless digital document management

Exporters

Faster document processing and reduced costs

Freight Forwarders

Streamlined logistics coordination

Trade Platforms

Enhanced platform capabilities

Banks

Simplified trade finance processes

Compliance Teams

Automated verification and audit trails

Potential Use Cases for Financial Institutions

Streamline trade finance operations with digital document workflows that support both traditional and direct financing models.

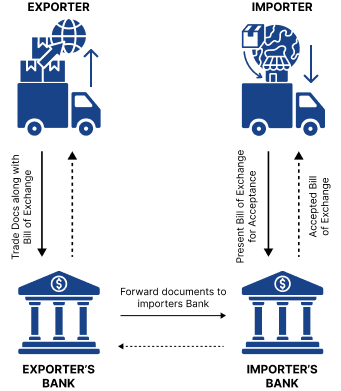

Use Case 1

Four Corner Model

Traditional trade finance model involving both exporter and importer banks, enabling secure document exchange and payment facilitation across international borders.

- Secure multi-party document verification

- Automated bill of exchange processing

- Real-time document status tracking

- Reduced settlement risks between banks

- Enhanced compliance and audit trails

Use Case 2

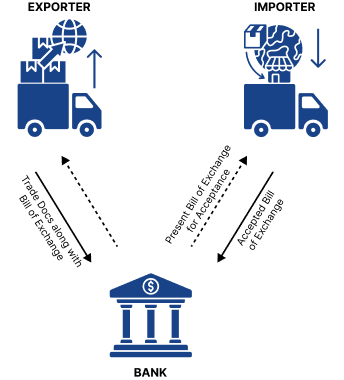

Three Corner Model

Streamlined direct financing model where a single bank facilitates the transaction directly with the exporter and importer, reducing complexity and processing time.

- Simplified single-bank workflow

- Faster document processing and payment

- Reduced operational complexity

- Lower transaction costs

- Direct relationship management

Why Choose Trade Docs for Your Institution?

Legal Compliance

MLETR and TradeTrust compliant digital documents with full legal validity

Instant Processing

Real-time document verification and transfer capabilities

Global Interoperability

Seamless integration with existing banking systems and international standards

Transform Your Trade Document Flows

Watch our platform revolutionize how trade documents are created, verified, and transferred across global supply chains

Ready to Digitize Your Trade Documents?

Join leading organizations already transforming their trade operations with Trade Docs

Start Your Digital Transformation

Transform your supply chain payments with instant, secure, and transparent solutions powered by advanced digital technology.

Latest from LinkedIn

Follow our latest insights, industry updates, and thought leadership content.

2 days ago

Tokenize Real Estate. Democratize Ownership. Event by Vayana Digital Assets Platform

2 days ago

Ripple’s latest “Banking on Digital Assets” report highlights how leading banks are moving beyond experimen…

Frequently Asked Questions

Who can use VDAP?

VDAP is designed for banks, financial institutions, fintechs, corporates, and investors looking to access efficient, transparent, and compliant digital markets.

What types of assets can be tokenized on VDAP?

VDAP supports tokenization of a wide range of assets including bonds, commercial paper, trade receivables, funds, equities, commodities, and real estate.

How does VDAP benefit financial institutions?

VDAP reduces operational costs, increases transparency, improves settlement speed, and provides new product opportunities through tokenization and digitization.

Is VDAP compliant with regulations?

Yes. VDAP is designed to align with global regulatory frameworks and incorporates compliance features such as KYC/KYB, investor onboarding, and audit trails.

Can VDAP integrate with existing systems?

Yes. VDAP offers APIs and modular deployment options that make it easy to integrate with banks’ and fintechs’ existing systems.

Does VDAP support cross-border use cases?

Absolutely. VDAP enables seamless cross-border issuance and investment, supporting multi-currency and jurisdictional requirements.

What kind of deployment options does VDAP offer?

VDAP can be deployed as a multi-tenant SaaS, a dedicated enterprise solution, or integrated into a bank’s/fintech’s infrastructure based on their requirements.

How does VDAP support investors?

Investors get access to new, diversified, and transparent asset classes with streamlined onboarding and simplified investment processes.

What role does blockchain play in VDAP?

Blockchain ensures transparency, traceability, and trust in all transactions, while enabling faster settlement and reducing operational risks.

How can we get started with VDAP?

You can connect with our team for a demo or pilot engagement. VDAP offers flexible models to help institutions start small and scale as adoption grows.