Tokenizing Real Estate for Global Market Access

Unlock liquidity, enable fractional ownership, and simplify distribution with compliant tokenization infrastructure built for institutions.

Bringing Real Estate On-Chain

High-value assets like real estate have historically been limited to a few due to high capital thresholds, limited liquidity, and complex operational processes. Tokenization is changing that by digitizing ownership, streamlining issuance, and enabling fractional investments in a fully compliant and programmable manner. At Vayana, we bring the power of blockchain to real estate, enabling trusted institutions, asset managers, and platforms to unlock efficiency and scalability through tokenization.

Why Tokenize Real Estate?

Fractional Ownership

Make high-value assets accessible to a broader investor base by dividing them into smaller digital units.

Liquidity Enablement

Facilitate secondary trading of tokenized assets via regulated exchanges or OTC platforms.

Operational Efficiency

Reduce reliance on intermediaries and manual processes with smart contracts and digitized workflows.

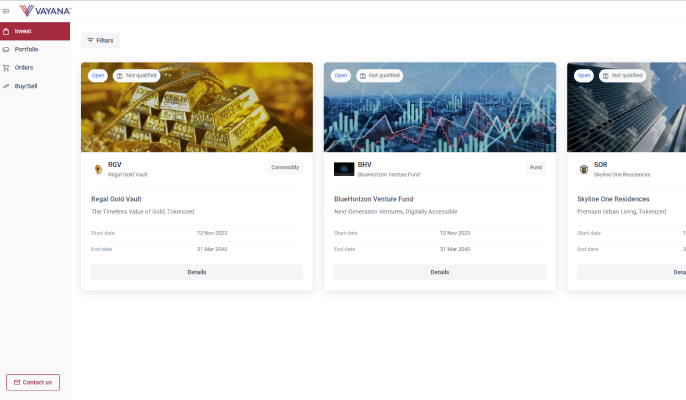

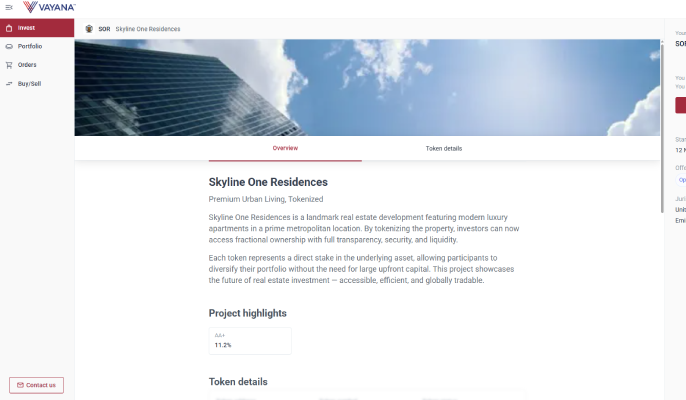

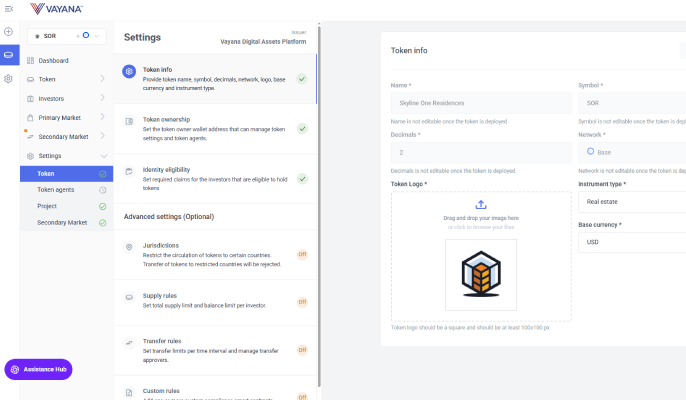

See the Platform in Action

Explore real screenshots of our tokenization platform, from investor dashboards to compliance management and trading interfaces.

Institutional-Grade Tokenization Infrastructure

Built for security, compliance, and scale, the Vayana Digital Assets Platform offers everything you need to tokenize and manage real estate across their lifecycle.

ERC-3643 Smart Contracts

Investor Registry & Wallets

Subscription & Distribution Engine

Regulatory Controls

& Compliance

Interoperable Architecture

Real-Time Audit Trail

Trusted by Ecosystems Across Asset Classes

Whether you’re an asset manager, tokenization platform, REIT, private fund, or fractional investment platform – our infrastructure supports diverse use cases with modularity and control.

Powered by ERC-3643 Standard

Leverage the most advanced compliant tokenization standard for secure, regulatory-aligned digital assets

Identity & Compliance

Built-in KYC/AML verification with on-chain identity registry ensuring only verified investors can participate

Transfer Restrictions

Programmable transfer rules that automatically enforce regulatory requirements and investment restrictions

Modular Architecture

Flexible smart contract framework that adapts to different asset classes and regulatory environments

Launch a Tokenized Offering in Weeks

Start small with a compliant, branded tokenization flow using our plug-and-play infrastructure. Whether it’s a

tokenized real estate project, fund unit, or alt-asset drop – go live in weeks, not months.

From Asset to Token in a Few Steps

Our streamlined tokenization process transforms traditional assets into compliant digital tokens through an integrated workflow designed

for institutional efficiency.

Select Type

of Asset

Legal & Valuation

Smart Contract Creation

ERC3643 Deployment

Investor Onboarding

KYC/AML Verification

Primary Distribution

Primary Offering

Post-Issuance Management

Compliance & Trading

Your Brand. Our Engine.

Offer a fully customized front-end for your investors while we manage the backend, smart contracts, and compliance. Focus on growth, while we handle the technology.

Your UI

Vayana Engine

Let's Tokenize

Step into the future of finance. Schedule a demo with our team and discover how the Vayana Digital Assets Platform can transform the way you issue, manage, and trade real-world assets.

Latest from LinkedIn

Follow our latest insights, industry updates, and thought leadership content.

2 days ago

Tokenize Real Estate. Democratize Ownership. Event by Vayana Digital Assets Platform

2 days ago

Ripple’s latest “Banking on Digital Assets” report highlights how leading banks are moving beyond experimen…

Frequently Asked Questions

Who can use VDAP?

VDAP is designed for banks, financial institutions, fintechs, corporates, and investors looking to access efficient, transparent, and compliant digital markets.

What types of assets can be tokenized on VDAP?

VDAP supports tokenization of a wide range of assets including bonds, commercial paper, trade receivables, funds, equities, commodities, and real estate.

How does VDAP benefit financial institutions?

VDAP reduces operational costs, increases transparency, improves settlement speed, and provides new product opportunities through tokenization and digitization.

Is VDAP compliant with regulations?

Yes. VDAP is designed to align with global regulatory frameworks and incorporates compliance features such as KYC/KYB, investor onboarding, and audit trails.

Can VDAP integrate with existing systems?

Yes. VDAP offers APIs and modular deployment options that make it easy to integrate with banks’ and fintechs’ existing systems.

Does VDAP support cross-border use cases?

Absolutely. VDAP enables seamless cross-border issuance and investment, supporting multi-currency and jurisdictional requirements.

What kind of deployment options does VDAP offer?

VDAP can be deployed as a multi-tenant SaaS, a dedicated enterprise solution, or integrated into a bank’s/fintech’s infrastructure based on their requirements.

How does VDAP support investors?

Investors get access to new, diversified, and transparent asset classes with streamlined onboarding and simplified investment processes.

What role does blockchain play in VDAP?

Blockchain ensures transparency, traceability, and trust in all transactions, while enabling faster settlement and reducing operational risks.

How can we get started with VDAP?

You can connect with our team for a demo or pilot engagement. VDAP offers flexible models to help institutions start small and scale as adoption grows.