Instant Payments.

Deep into Your Supply Chain.

Revolutionize payments across your entire supply chain ecosystem in India with our Deep-Tier Supply Chain Payments platform – enabling instant, secure, and transparent transactions for every supplier.

What is Deep-Tier Supply Chain Payments?

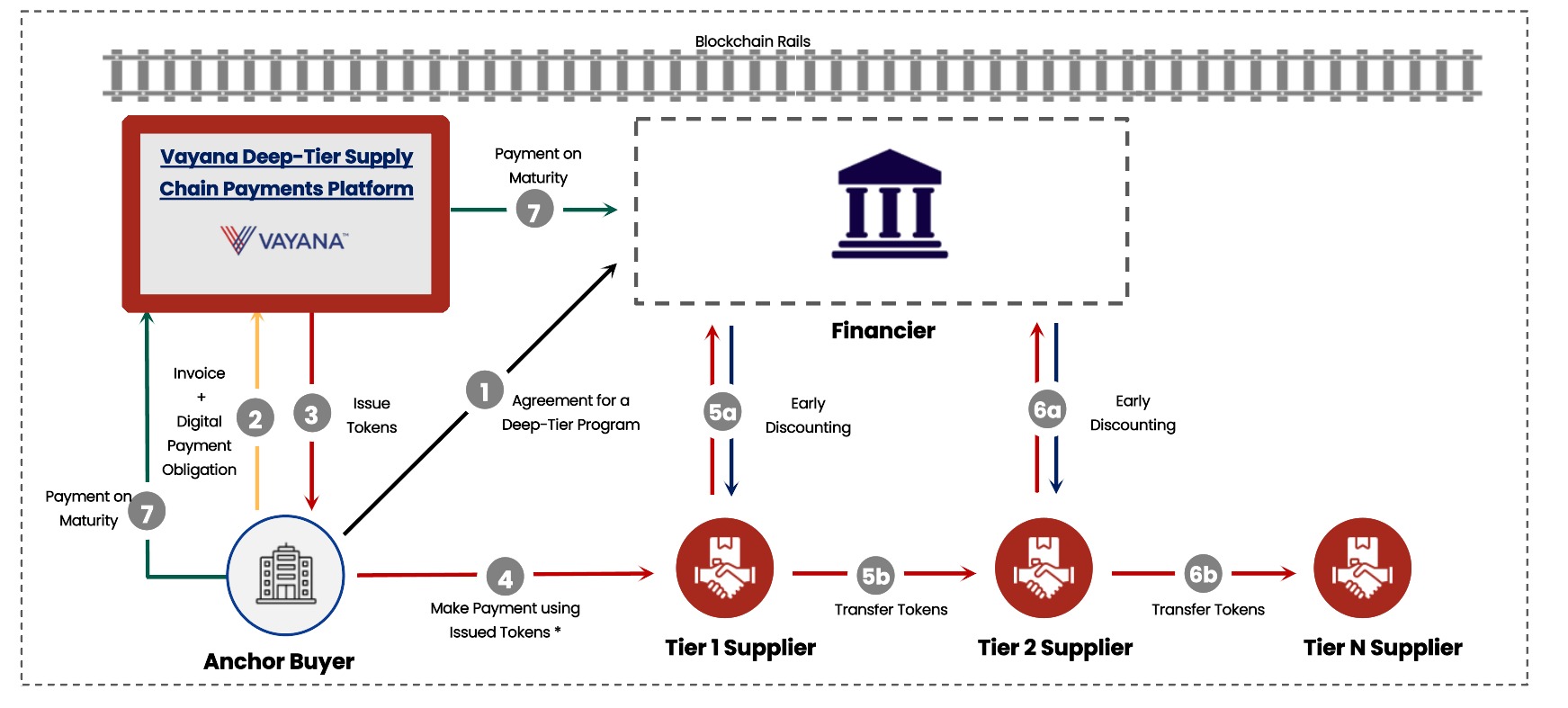

Traditional payment systems in India often exclude smaller suppliers from instant payment benefits, creating cash flow challenges across the supply chain. Our Deep-Tier Supply Chain Payments platform extends instant, digital payments to every tier of your supply chain, leveraging India's robust digital infrastructure and advanced payment technology.

Digital Integration

Seamless integration with existing payment systems.

Instant Settlement

Real-time payments across all supplier tiers.

Advanced Security

secure transaction records and automated payment processing.

MSME Inclusion

Bringing India's small businesses into the digital economy.

Why Deep-Tier Payments Matter in India

India's MSME sector contributes 30% to GDP but faces significant payment delays, impacting cash flow and growth potential.

Instant Payments

Real-time settlements for all tiers

Cost Reduction

Lower transaction costs via digital payments

Digital Inclusion

Mobile-first approach for MSMEs

Transparency

Complete audit trails and reporting

6.3 Crore

MSMEs in India need better payment solutions

45 Days

Average payment cycle for small suppliers

₹500Cr+

Daily digital transaction volume potential

How Deep-Tier Payments Work in India

Leveraging advanced digital technology and payment infrastructure for seamless multi-tier payments

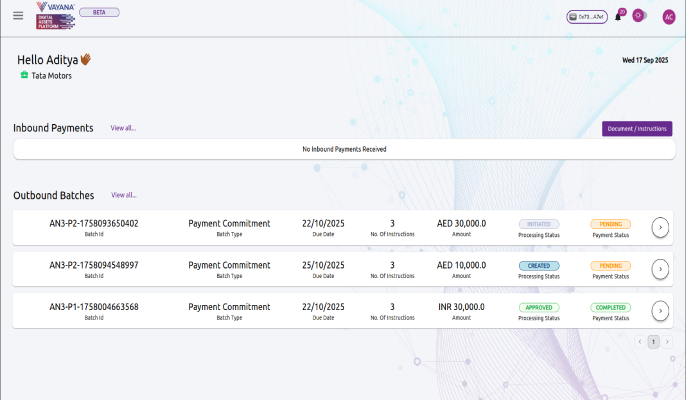

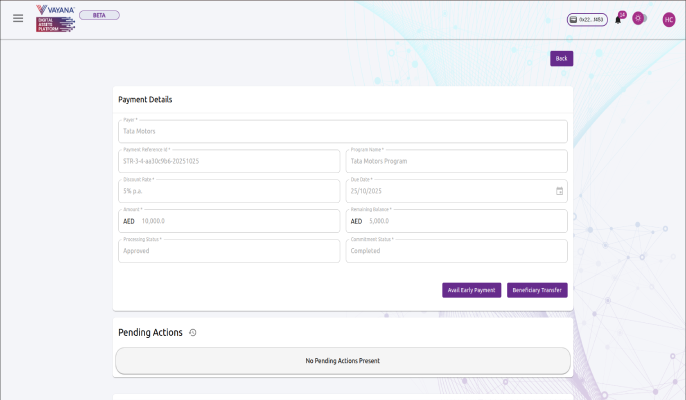

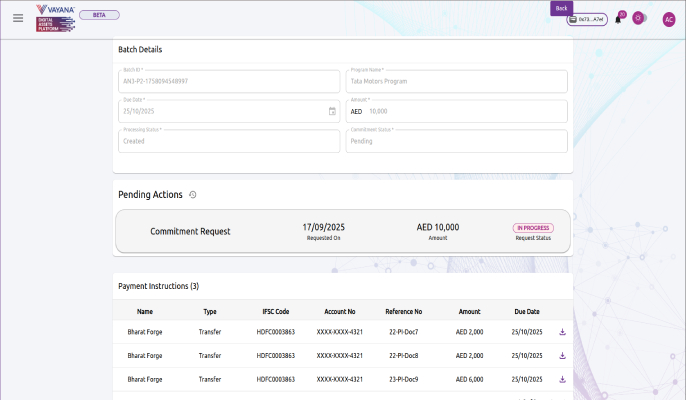

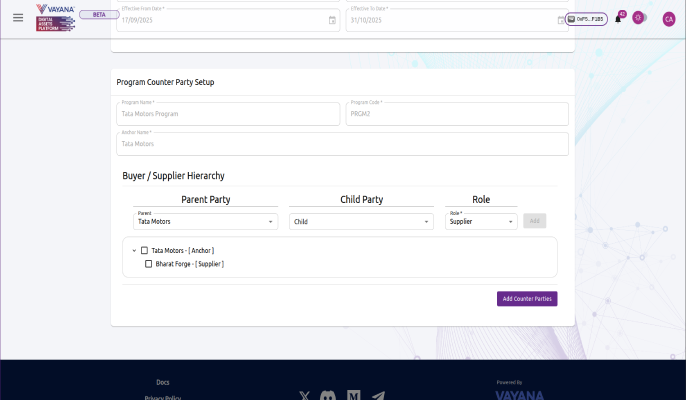

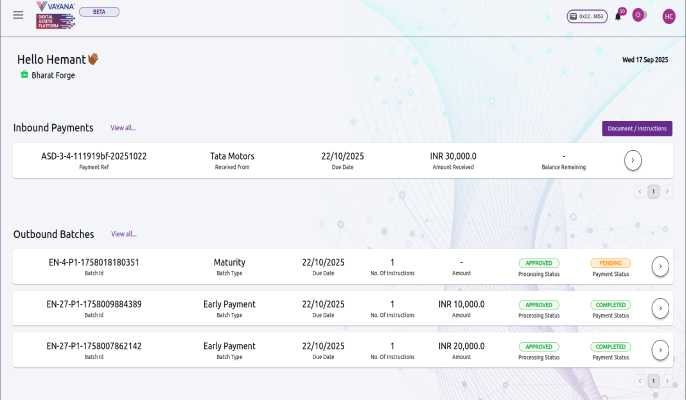

See the Platform in Action

Explore real screenshots of our tokenization platform, from investor dashboards to compliance management and trading interfaces.

Digital Security

Bank-grade encryption & authentication

Instant Settlement

Real-time payment processing

Multi-tier Integration

From Tier 1 to deepest supplier levels

Scalable Payments

Volume-based processing capabilities

Benefits for Indian Supply Chain Ecosystem

Large Corporations

- Improved supplier relationships

- Better working capital management

- Enhanced supply chain visibility

- ESG compliance tracking

MSMEs & Suppliers

- Instant payment settlements

- Reduced transaction costs

- Digital payment history

- Access to credit scoring

Financial Institution

- Real-time transaction monitoring

- Complete audit trails

- Integration with existing systems

- Regulatory compliance support

Our Differentiators in Indian Market

Traditional Payments

Limited digital capabilities with manual processing bottlenecks

- Manual verification processes

- Delayed settlements

- Limited MSME accessibility

Our Deep-Tier Supply Chain Payments Platform

Advanced digital payment solutions for the Indian market

- Fully automated workflows

- Instant settlements

- MSME-friendly interface

Anchor Credit Utilization

Leverage anchor creditworthiness across tiers

MSME Onboarding at Scale

Digital onboarding for thousands of MSMEs

Real-time Transaction Data

Live visibility into payment flows and risks

Digital Document Exchange

Automated invoice and document processing

Use Cases

Explore real transformations across Indian industries through instant payment solutions

Digital India initiative

Digital India Manufacturing

Instant payments across automotive supply chain

- Digital Integration

- MSME Empowerment

- Real-time Settlement

Made in India support

Textile Industry Revolution

Transforming traditional textile payments

- Traditional to Digital

- Instant Processing

- Cost Reduction

Farmer welfare program

Agriculture Payment Innovation

Bringing farmers into digital payment ecosystem

- Rural Inclusion

- Mobile-first

- Government Alignment

Who is it for?

Empowering India's digital payment ecosystem from large corporations to rural MSMEs

Large Indian Corporations

Multinational companies and large enterprises looking to digitize their supply chain payments across India

- Supply Chain Digitization

- MSME Payment Management

- Compliance Automation

MSMEs & Small Businesses

India’s 6.3 crore MSMEs seeking instant payment solutions and digital financial inclusion

- Digital payment receipt

- Digital payment history

- Easy integration

Financial Institutions

Banks, NBFCs, and payment service providers wanting to serve the supply chain payment ecosystem

- Payment Infrastructure

- Regulatory Compliance

- Transaction Monitoring

Ready to Transform Your Supply Chain Payments?

Join leading organizations already transforming their payment operations with Deep-Tier Supply Chain Payments

Start Your Digital Transformation

Transform your supply chain payments with instant, secure, and transparent solutions powered by advanced digital technology.

Latest from LinkedIn

Follow our latest insights, industry updates, and thought leadership content.

2 days ago

Tokenize Real Estate. Democratize Ownership. Event by Vayana Digital Assets Platform

2 days ago

Ripple’s latest “Banking on Digital Assets” report highlights how leading banks are moving beyond experimen…

Frequently Asked Questions

Who can use VDAP?

VDAP is designed for banks, financial institutions, fintechs, corporates, and investors looking to access efficient, transparent, and compliant digital markets.

What types of assets can be tokenized on VDAP?

VDAP supports tokenization of a wide range of assets including bonds, commercial paper, trade receivables, funds, equities, commodities, and real estate.

How does VDAP benefit financial institutions?

VDAP reduces operational costs, increases transparency, improves settlement speed, and provides new product opportunities through tokenization and digitization.

Is VDAP compliant with regulations?

Yes. VDAP is designed to align with global regulatory frameworks and incorporates compliance features such as KYC/KYB, investor onboarding, and audit trails.

Can VDAP integrate with existing systems?

Yes. VDAP offers APIs and modular deployment options that make it easy to integrate with banks’ and fintechs’ existing systems.

Does VDAP support cross-border use cases?

Absolutely. VDAP enables seamless cross-border issuance and investment, supporting multi-currency and jurisdictional requirements.

What kind of deployment options does VDAP offer?

VDAP can be deployed as a multi-tenant SaaS, a dedicated enterprise solution, or integrated into a bank’s/fintech’s infrastructure based on their requirements.

How does VDAP support investors?

Investors get access to new, diversified, and transparent asset classes with streamlined onboarding and simplified investment processes.

What role does blockchain play in VDAP?

Blockchain ensures transparency, traceability, and trust in all transactions, while enabling faster settlement and reducing operational risks.

How can we get started with VDAP?

You can connect with our team for a demo or pilot engagement. VDAP offers flexible models to help institutions start small and scale as adoption grows.