Reimagining Bond Markets for the Digital Age

From private placements to tokenized debt, VDAP streamlines the full lifecycle – issuance, distribution, and post-trade, all on one platform

Transparent Pricing Options

Choose the right plan for your business needs

Starter SaaS

$1,000

Month

$7,500 one-time setup

Best For: Pilots, Trials

- Up to 2 issuances

- Logo only branding

- No customization

- No integrations

- EVM Chains supported

- Standard Email Support

- 1-2 Weeks deployment

- 0.5% success fee of drawdown

Mid-tier SaaS

$2,000

Month

$10,000 one-time setup

Best For: Early Commercial Use

- Up to 20 issuances

- Logo + UI Color branding

- Email Text customization

- Pre-approved integrations

- EVM Chains supported

- Priority Email/Phone Support

- 1-2 Weeks deployment

- 0.3% success fee of drawdown

Advanced SaaS

$3,000

Month

$15,000 one-time setup

Best For: Scale-ready Fintechs/Banks

- Unlimited issuances

- Full UI Branding

- Workflow Changes customization

- Pre-approved + Optional Add-ons

- EVM Chains supported

- Priority + Telegram Support

- 2-3 Weeks deployment

- 0.25% or monthly fee (whichever is higher)

Custom self-hosted deployments for banks, regulated entities, and large institutions

- Dedicated infrastructure

- Private blockchain options

- Custom SLAs and support

- Full white-labeling

Tokenization of Debt Instruments

Our solution enables financial institutions to issue, manage, and service tokenized debt instruments – including loans, debentures, and structured credit – on a secure, compliant blockchain. By introducing automation, transparency, and digital-native workflows, it transforms traditional, manual debt processes into a faster, more efficient, and fully digital experience.

Tokenization of Debt Instruments

Workflow Automation

Multi-Tenant SaaS

Built-in Compliance

API-First & Interoperable

Rapid

Go-Live

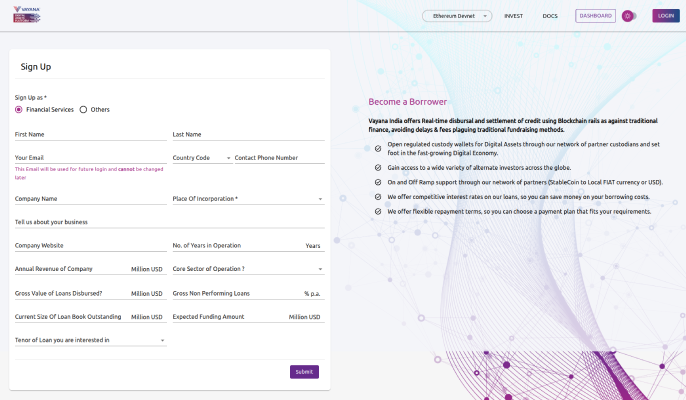

How You Can Participate

Public Access & Onboarding

- Explore Investment Opportunities : Preview deals and performance metrics.

- Easy Onboarding: Borrowers and investors can apply through simple forms.

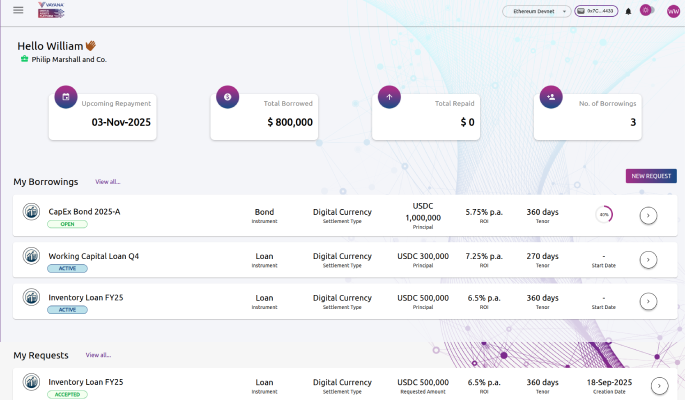

For Borrowers

- Raise Capital : Create loan or bond requests with full documentation.

- Manage Your Profile : Update details, whitelist wallets, and monitor activities.

- Track Everything : Get real-time views, download statements, and receive alerts.

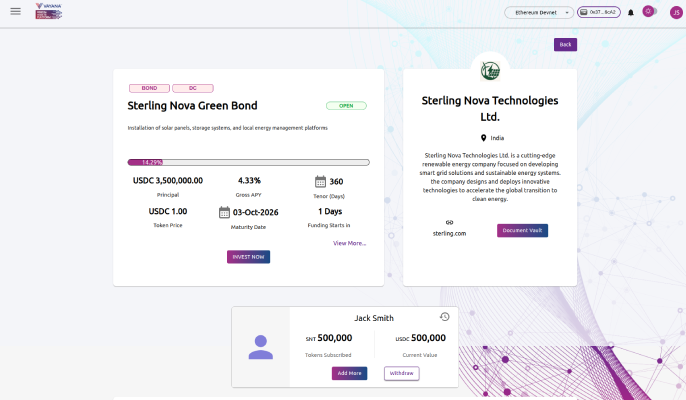

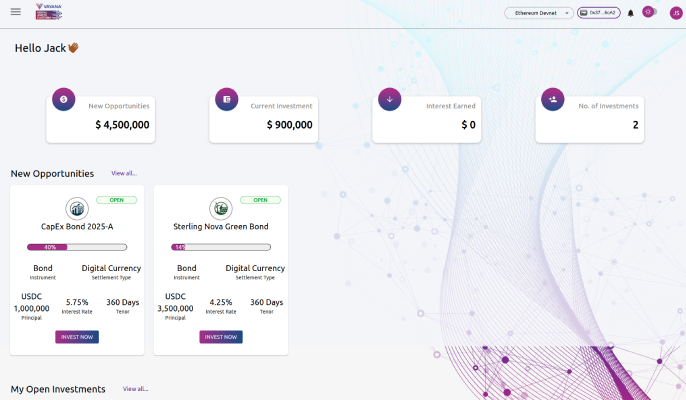

For Investors

- Discover & Invest : Browse active deals and invest via multiple payment methods.

- Stay Informed : Access reports, track investments, and get periodic statements.

- Participate in Governance : Vote on key decisions and receive important updates.

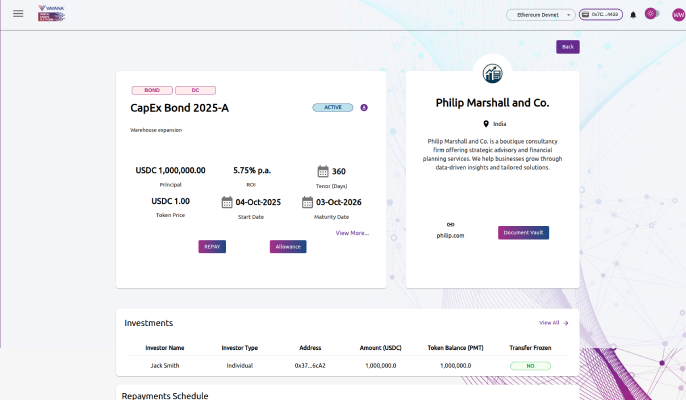

See the Platform in Action

Explore real screenshots of our tokenization platform, from investor dashboards to compliance management and trading interfaces.

Go from Term Sheet to Tokenized Debt in Days, Not Months

Our platform dramatically accelerates your time-to-market with pre-built templates, smart contract libraries, and compliance frameworks designed for private credit.

How It Works

A streamlined process to digitize your assets on the Vayana Digital Assets Platform

Select Type

of Asset

Loan, Bond, Commercial Paper or other Real World Asset

Configure

Asset Terms

Compliance, Repayments and other Trading Restrictions

Investor

Subscription

Mint Tokens, Document Signatures and more

Post Issuance

Management

Interest Payments, Trading, Default Tracking, and more

Powering Modern Private Credit Markets

Seamlessly and Securely

Enterprise-Grade Tokenization with VDAP.

Attract diverse investor classes | Automate issuance and compliance | White-label friendly

Asset Tokenization

Launch Tokenized Debt Instruments

- Built-in compliance (e.g., KYC, investor eligibility)

- Customizable transfer logic (limits, conditions)

- Ready-to-use templates for faster go-live

Lifecycle Management

Manage Securities Across Lifecycle

Maintain complete control over tokenized credit instruments post-issuance. Authorize actions, update records, and automate lifecycle events like interest payments, redemptions, and reporting.

- Role-based permissions

- Smart contract-driven actions (mint, burn, lock, transfer)

- Dashboard view for all positions and updates

Distribution

Enable Multi-Channel Distribution

List, sell, or transfer tokenized instruments across regulated networks, private marketplaces, or institutional investor portals. Bridge to DeFi channels with built-in compliance controls without losing oversight.

- Compatible with exchanges and broker-dealers

- Supports programmable compliance on every transaction

- Plug-and-play integrations for wider distribution reach

Let's Tokenize

Step into the future of finance. Schedule a demo with our team and discover how the Vayana Digital Assets Platform can transform the way you issue, manage, and trade real-world assets.

Latest from LinkedIn

Follow our latest insights, industry updates, and thought leadership content.

2 days ago

Tokenize Real Estate. Democratize Ownership. Event by Vayana Digital Assets Platform

2 days ago

Ripple’s latest “Banking on Digital Assets” report highlights how leading banks are moving beyond experimen…

Frequently Asked Questions

Who can use VDAP?

VDAP is designed for banks, financial institutions, fintechs, corporates, and investors looking to access efficient, transparent, and compliant digital markets.

What types of assets can be tokenized on VDAP?

VDAP supports tokenization of a wide range of assets including bonds, commercial paper, trade receivables, funds, equities, commodities, and real estate.

How does VDAP benefit financial institutions?

VDAP reduces operational costs, increases transparency, improves settlement speed, and provides new product opportunities through tokenization and digitization.

Is VDAP compliant with regulations?

Yes. VDAP is designed to align with global regulatory frameworks and incorporates compliance features such as KYC/KYB, investor onboarding, and audit trails.

Can VDAP integrate with existing systems?

Yes. VDAP offers APIs and modular deployment options that make it easy to integrate with banks’ and fintechs’ existing systems.

Does VDAP support cross-border use cases?

Absolutely. VDAP enables seamless cross-border issuance and investment, supporting multi-currency and jurisdictional requirements.

What kind of deployment options does VDAP offer?

VDAP can be deployed as a multi-tenant SaaS, a dedicated enterprise solution, or integrated into a bank’s/fintech’s infrastructure based on their requirements.

How does VDAP support investors?

Investors get access to new, diversified, and transparent asset classes with streamlined onboarding and simplified investment processes.

What role does blockchain play in VDAP?

Blockchain ensures transparency, traceability, and trust in all transactions, while enabling faster settlement and reducing operational risks.

How can we get started with VDAP?

You can connect with our team for a demo or pilot engagement. VDAP offers flexible models to help institutions start small and scale as adoption grows.